Short-Term and Long-Term Asymmetric Effects of Macroeconomic Variables on Foreign Direct Investment Flows Using the PMG Approach (Case Study: Selected OPEC Member Countries)

Keywords:

Macroeconomic Variables, Foreign Direct Investment, Pooled Mean Group Approach, OPEC Member CountriesAbstract

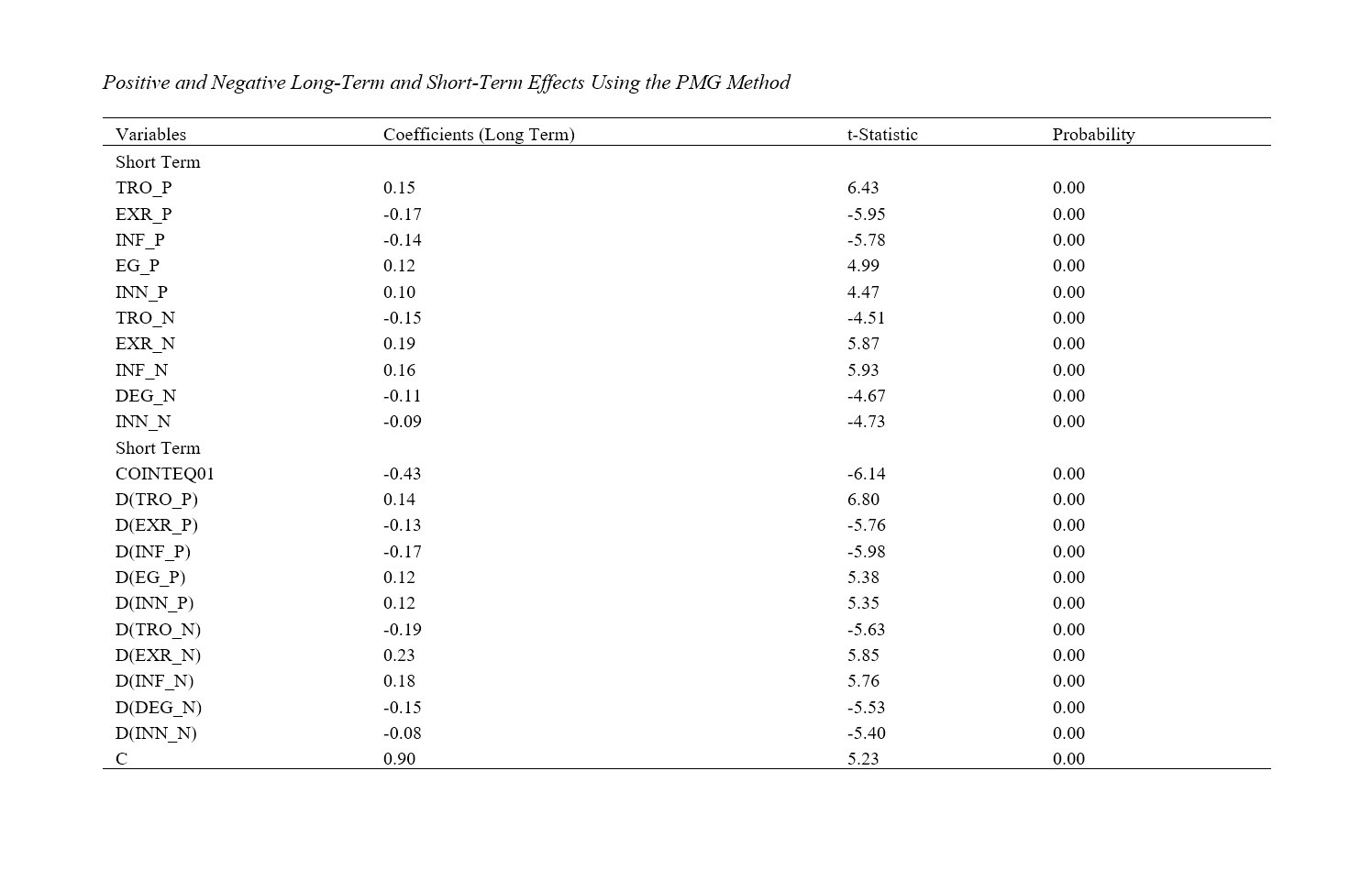

The motivation behind attracting foreign direct investment (FDI) stems from the widespread belief that beyond providing financial resources, FDI serves additional purposes such as promoting technology transfer, enhancing skills and management practices to improve the quality of the domestic labor force, expanding export markets, raising the standards of domestic production, and facilitating a transition toward a market-based economy. The objective of this study is to analyze and examine the short-term and long-term asymmetric effects of macroeconomic variables on FDI flows in selected OPEC member countries, including Iran, Iraq, Saudi Arabia, Kuwait, Venezuela, the United Arab Emirates, Gabon, and the Republic of the Congo over the period from 2007 to 2022. Accordingly, the Pooled Mean Group (PMG) estimation method within the framework of panel data was employed. The results indicate that the asymmetric effects of trade openness, economic growth, and innovation on FDI flows in both the short and long term are positive and statistically significant for this group of countries. Conversely, the asymmetric effects of exchange rate and inflation on FDI flows in the short and long term are negative and statistically significant. Additionally, the error correction coefficient in the model was estimated to be negative and statistically significant at the 1% level, with a value of -0.43. This implies that the system adjusts toward its long-term equilibrium at a speed of 43%, meaning that in each period, 43% of the existing disequilibria are corrected in the direction of achieving long-term balance.

References

Bao, H. H. G., & Le, H. P. (2021). ASEAN's trade balance with the whole EU-28 at industry level: the role of vehicle currency. J. Econ. Asymmetries, 24, 1-17. https://doi.org/10.1016/j.jeca.2021.e00230

Chen, C., & Peng, H. (2019). Research on the relation between OFDI and export trade of China Malaysia.

Feshari, M. (2019). Investigating the effect of real exchange rate instability on Iran's foreign direct investment using a nonlinear Markov switching approach. Economic Growth and Development Research Quarterly, 8(31), 135-150.

Hamid, I., Alam, M. S., Kanwal, A., Jena, P. K., Murshed, M., & Alam, R. (2022). Decarbonization pathways: the roles of foreign direct investments, governance, democracy, economic growth, and renewable energy transition. Environ. Sci. Pollut. Control Ser., 29(33), 49816-49831. https://doi.org/10.1007/s11356-022-18935-3

Hoa, P., Thu, H., & Duc, D. (2021). Factors affecting the attraction of foreign direct investment: A study in northwest of Vietnam. Accounting, 7(6), 1257-1264. https://doi.org/10.5267/j.ac.2021.4.014

Kogabayev, T., & Maziliauskas, A. (2017). The definition and classification of innovation. Holistic-Journal of Business and Public Administration, 8(1), 59-72. https://doi.org/10.1515/hjbpa-2017-0005

Kong, Y., Glascock, J., & Lu, A. R. (2016). An Investigation into Real Estate Investment and Economic Growth in China: A Dynamic Panel Data Approach. Sustainability, 8(1), 66-84. https://doi.org/10.3390/su8010066

Kordi, A., & Mashhadi Khodaparast, M. (2016). The impact of corruption on foreign direct investment in developing countries. Financial Economics Quarterly, 10(36), 33-50.

Madani, G., & Madani, G. (2020). Investigating the impact of human capital on foreign direct investment

Moleiro Martins, J. e., Azeem Gul, c., Mario ' Nuno Mata a, b., Syed Arslan Haider, d., & Sareer Ahmad, e. (2023). Do economic freedom, innovation, and technology enhance Chinese FDI? A cross-country panel data analysis. Heliyon, 9, e16668. https://doi.org/10.1016/j.heliyon.2023.e16668

Nguea, S. M. (2020). The impact of infrastructure development on foreign direct investment in Cameroon. Economics Bulletin, Access Economic, 41(3), 1113-1124.

Nikpey Pasian, V., Hekmati Farid, S., Mohammadzadeh, Y., & Nezaei, F. (2022). Investigating the impact of economic structural vulnerability on attracting foreign direct investment in MENA countries. Economic Research Quarterly, 22(3), 245-270.

Ranjbar, O., & Rassekh, F. (2022). Does economic complexity influence the efficacy of foreign direct investment? An empirical inquiry. The Journal of International Trade & Economic Development, 33(1), 57-76. https://doi.org/10.1080/09638199.2022.2036792

Safarzadeh, G., & Khodaveisi, H. (2019). The asymmetric effect of inflation on attracting foreign direct investment in Iran. Quarterly Journal of Economic Research, 54(4, Consecutive No. 129), 917-945.

Shahabadi, A., Abedini, R., & Moradi, A. (2021). The effect of total factor productivity on attracting foreign direct investment in industrial economic blocs. Industrial Economic Research (Quarterly), 5(16), 13-24.

Simeon Oludiran, A., & Nicaise Abimbola, L. (2018). Major determinants of foreign direct investment in the west African economic and monetary region. Iranian Economic Review, 22(1), 121-162.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Mohammed Majeed Rasool Almamar, Saeed Daei Karimzadeh, Mayih Shabeeb Hadhood AL-Shammari, Mostafa Rajabi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.