Optimization of Renewable Energy Investment Costs in the Private Sector Considering Government Support Policies

Keywords:

Renewable Energy, Investment Cost , Energy Production, Game Theory, StackelbergAbstract

Global experience indicates that the implementation of attractive tariff schemes has led to an increased share of bioenergy and renewable energy sources in the energy distribution network. When properly designed, such policies can ensure cost recovery for producers and investors in the renewable energy sector. Accordingly, this paper seeks to propose a model, based on a game theory approach, to maintain the profit levels of stakeholders. In this context, the leader model incorporates government subsidies, while the follower model represents the profit levels of renewable energy producers. The proposed model aims to identify optimal subsidy policies by considering various factors, thereby sustaining the private sector’s motivation to invest in renewable energy production. The results demonstrate that an increase in government support through different policy interventions leads to higher profit margins for companies. On the other hand, as the number of renewable energy producers (companies) grows, the total government subsidies increase, prompting policymakers to implement measures that enhance market competition and thereby reduce corporate profitability.

References

Brown, G., Carlyle, M., Salmerón, J., & Wood, K. (2006). Defending critical infrastructure. Interfaces, 36(6), 530-544.

Chang, K., Wan, Q., Lou, Q., Chen, Y., & Wang, W. (2020). Green fiscal policy and firms’ investment efficiency: New insights into firm-level panel data from the renewable energy industry in China. Renewable Energy, 151, 589-597. https://doi.org/https://doi.org/10.1016/j.renene.2019.11.064

Fathi, F., & Bakhshoodeh, M. (2021). Economic and environmental strategies against targeting energy subsidy in Iranian meat market: A game theory approach. Energy Policy, 150, 112153. https://doi.org/https://doi.org/10.1016/j.enpol.2021.112153

Khalili, S., Lopez, G., & Breyer, C. (2025). Role and trends of flexibility options in 100% renewable energy system analyses towards the Power-to-X Economy. Renewable and Sustainable Energy Reviews, 212, 115383.

Koh, J. J., Ding, G., Heckman, C., Chen, L., & Roncone, A. (2020). Cooperative control of mobile robots with stackelberg learning. 2020 IEEE/RSJ International Conference on Intelligent Robots and Systems (IROS),

Lin, B., & Zhu, J. (2019). The role of renewable energy technological innovation on climate change: Empirical evidence from China. Science of The Total Environment, 659, 1505-1512. https://doi.org/https://doi.org/10.1016/j.scitotenv.2018.12.449

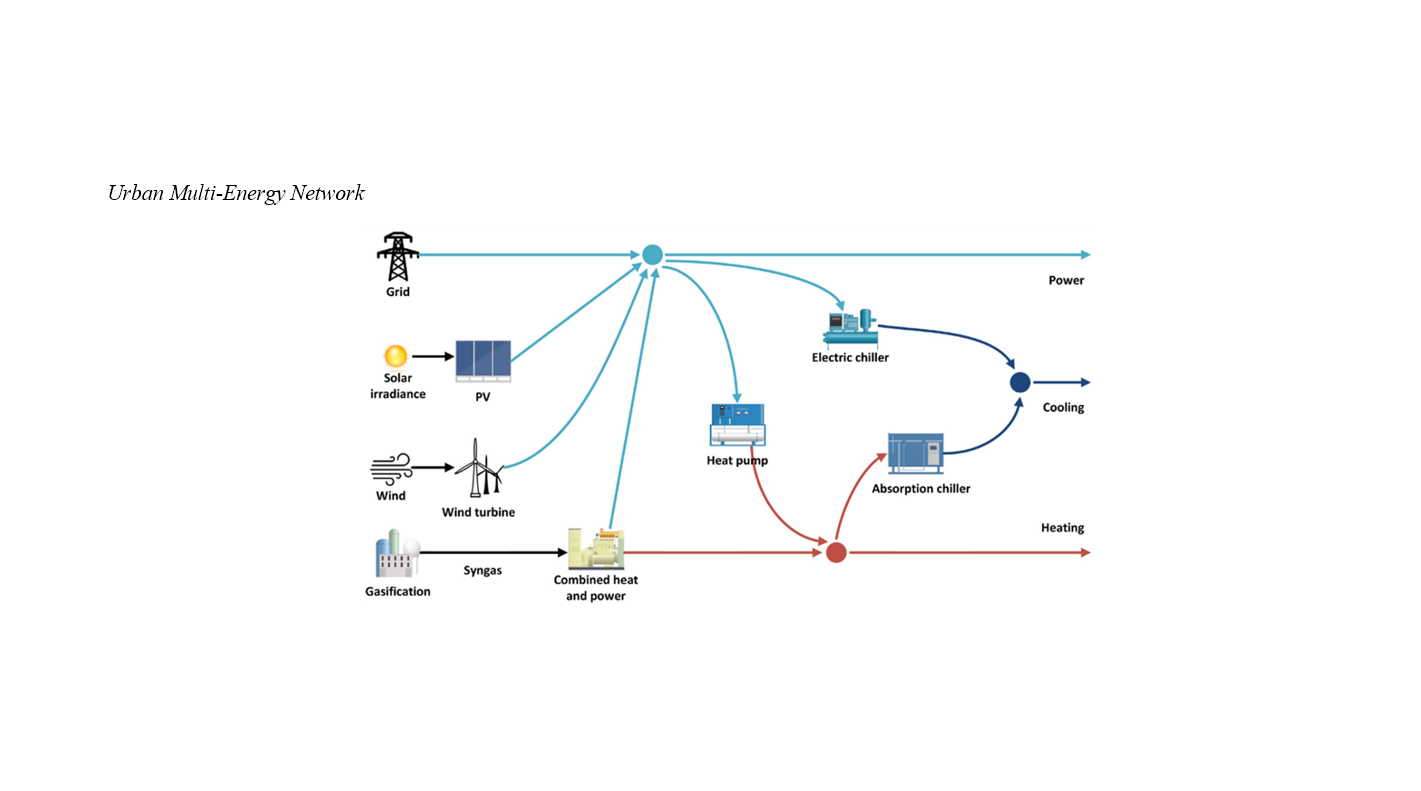

Liu, Z., Wang, S., Lim, M. Q., Kraft, M., & Wang, X. (2021). Game theory-based renewable multi-energy system design and subsidy strategy optimization. Advances in Applied Energy, 2, 100024. https://doi.org/https://doi.org/10.1016/j.adapen.2021.100024

Lund, P. D. (2009). Effects of energy policies on industry expansion in renewable energy. Renewable Energy, 34(1), 53-64. https://doi.org/https://doi.org/10.1016/j.renene.2008.03.018

Maroušek, J., Hašková, S., Zeman, R., Váchal, J., & Vaníčková, R. (2015). Assessing the implications of EU subsidy policy on renewable energy in Czech Republic. Clean Technologies and Environmental Policy, 17(2), 549-554. https://doi.org/10.1007/s10098-014-0800-1

Martelli, E., Freschini, M., & Zatti, M. (2020). Optimization of renewable energy subsidy and carbon tax for multi energy systems using bilevel programming. Applied Energy, 267, 115089. https://doi.org/https://doi.org/10.1016/j.apenergy.2020.115089

Murshed, M. (2020). An empirical analysis of the non-linear impacts of ICT-trade openness on renewable energy transition, energy efficiency, clean cooking fuel access and environmental sustainability in South Asia. Environmental Science and Pollution Research, 27(29), 36254-36281. https://doi.org/10.1007/s11356-020-09497-3

Myojo, S., & Ohashi, H. (2018). Effects of consumer subsidies for renewable energy on industry growth and social welfare: The case of solar photovoltaic systems in Japan. Journal of the Japanese and International Economies, 48, 55-67. https://doi.org/https://doi.org/10.1016/j.jjie.2017.11.001

Salichs, M. A., Ge, S. S., Barakova, E. I., Cabibihan, J.-J., Wagner, A. R., Castro-González, Á., & He, H. (2019). Social Robotics: 11th International Conference, ICSR 2019, Madrid, Spain, November 26–29, 2019, Proceedings (Vol. 11876). Springer Nature.

Su, Y., Lv, H., Zhou, W., & Zhang, C. (2021). Review of the hydrogen permeability of the liner material of type IV on-board hydrogen storage tank. World Electric Vehicle Journal, 12(3), 130.

Xie, Y., & Lin, B. (2025). Financial leasing and China’s renewable energy firms' investment behavior: In the context of government subsidy reduction. Renewable and Sustainable Energy Reviews, 214, 115547.

Yang, X., He, L., Xia, Y., & Chen, Y. (2019). Effect of government subsidies on renewable energy investments: The threshold effect. Energy Policy, 132, 156-166. https://doi.org/10.1016/j.enpol.2019.05.039

Yi, Z., Xin-gang, Z., Yu-zhuo, Z., & Ying, Z. (2019). From feed-in tariff to renewable portfolio standards: An evolutionary game theory perspective. Journal of Cleaner Production, 213, 1274-1289. https://doi.org/https://doi.org/10.1016/j.jclepro.2018.12.170

Zhang, X., Hao, Z., Singh, V. P., Zhang, Y., Feng, S., Xu, Y., & Hao, F. (2022). Drought propagation under global warming: Characteristics, approaches, processes, and controlling factors. Science of The Total Environment, 838, 156021.

Zhao, H.-r., Guo, S., & Fu, L.-w. (2014). Review on the costs and benefits of renewable energy power subsidy in China. Renewable and Sustainable Energy Reviews, 37, 538-549. https://doi.org/https://doi.org/10.1016/j.rser.2014.05.061

Zhao, N., Xia, T., Yu, T., & Liu, C. (2020). Subsidy-Related Deception Behavior in Energy-Saving Products Based on Game Theory [Original Research]. Frontiers in Energy Research, Volume 7 - 2019. https://doi.org/10.3389/fenrg.2019.00154

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Hassan Ali Aria, Hamed Kazemipoor, Amir Naser Akhavan, Akbar Alamtabriz (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.