An Optimal Model for Managing Assets, Liabilities, and Equity in Commercial Banks under the Supervisory Regulations of the Central Bank of Iran

Keywords:

Optimal model, Asset management, Liability management;, Equity management, Central Bank regulations, Commercial banks, Fuzzy goal programmingAbstract

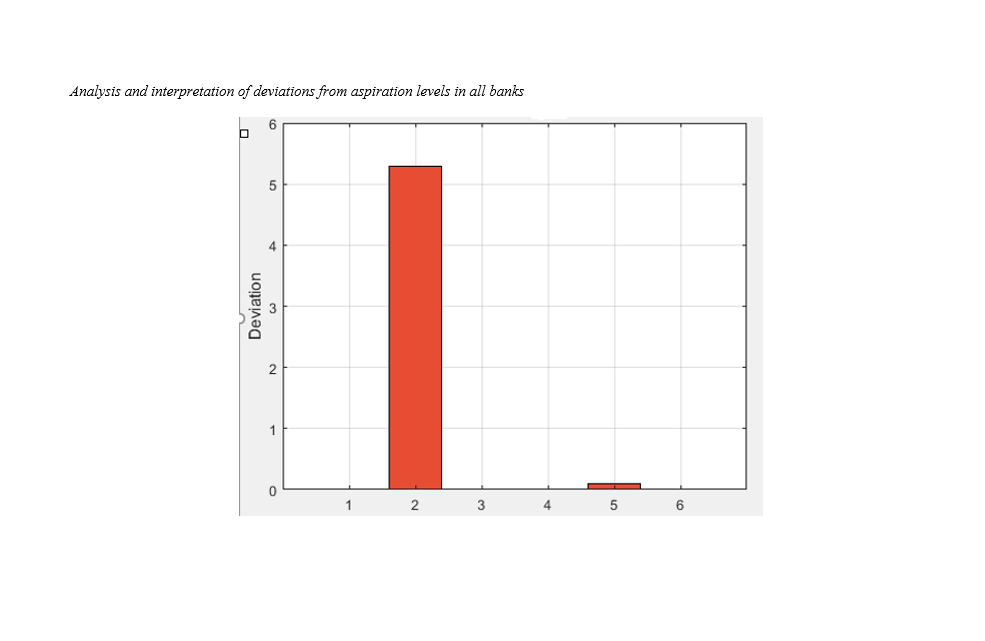

This study aimed to develop an optimal model for managing assets, liabilities, and equity in Iranian commercial banks in compliance with Central Bank supervisory regulations. This applied research used audited financial statements of ten listed commercial banks (Mellat, Tejarat, Saderat, Parsian, Pasargad, Eghtesad Novin, Sina, Dey, Karafarin, and Middle East) during 2019–2023. Data were collected from CODAL, the Central Bank of Iran, and related financial databases. The methodology integrated the Best-Worst Method (BWM) for weighting decision variables and a fuzzy goal programming approach to manage uncertainty and set realistic target ranges. Six key decision criteria were evaluated: return on assets (ROA), return on equity (ROE), liquidity risk ratio (LRR), capital adequacy ratio (CAR), non-performing assets (NPA), and market share of deposits and credits (MSDL). The findings revealed that “capital adequacy ratio” ranked as the most critical criterion (average weight 0.4699), followed by liquidity risk ratio and reduction of non-performing assets. In contrast, market share of deposits and credits had the lowest priority. Results of the optimization model indicated that all banks achieved full compliance with Central Bank requirements after modest adjustments. The most recurrent deviations were observed in return on equity, which consistently required reduction across banks, averaging 1.1 percentage points below optimal values. Liquidity ratios and capital adequacy remained within acceptable ranges across institutions, while non-performing assets showed only minor deviations. Banks such as Mellat and Sina required minimal reforms, whereas Parsian, Middle East, and Eghtesad Novin demanded more extensive adjustments to balance their financial structures. The proposed fuzzy goal programming model provides a robust framework for balancing profitability, risk, and compliance.

References

Albanese, C., Crépey, S., Hoskinson, R., & Saadeddine, B. (2021). XVA analysis from the balance sheet. Quantitative Finance, 21(1), 99-123. https://doi.org/10.1080/14697688.2020.1817533

Bakkar, Y., De Jonghe, O., & Tarazi, A. (2023). Does banks' systemic importance affect their capital structure and balance sheet adjustment processes? Journal of Banking & Finance, 151, 105518. https://doi.org/10.1016/j.jbankfin.2019.03.002

Basheer, M. F., Waemustafa, W., Hidthiir, M. H. B., & Hassan, S. G. (2021). Explaining the endogeneity between the credit risk, liquidity risk, and off-balance sheet activities in commercial banks: a case of South Asian economies. International Journal of Monetary Economics and Finance, 14(2), 166-187. https://doi.org/10.1504/IJMEF.2021.114032

Buchak, G., Matvos, G., Piskorski, T., & Seru, A. (2024). Beyond the balance sheet model of banking: Implications for bank regulation and monetary policy. Journal of Political Economy, 132(2), 616-693. https://doi.org/10.1086/726703

Ghodrzi, A., Tehrani, R., & Soori, A. (2024). Optimizing Investment Portfolios of Insurance Companies Using Copula Functions and Value at Risk Approach. Investment Knowledge, 13(49), 325-352. http://www.jik-ifea.ir/article_22064.html?lang=en

Gholami, S., Rezaei, N., Abdi, R., & Aghapouramin, V. (2024). Examining Asset-Liability Management Mechanisms in Investment Funds Based on a Data-Driven Approach. Journal of Management Accounting and Auditing, 15(58), 519-535. https://www.jmaak.ir/article_23890.html?lang=en

Hao, C., & Lixia, W. (2023). Does equity pledge of major shareholders affect investment efficiency? Finance Research Letters, 58, 104272. https://doi.org/10.1016/j.frl.2023.104272

Islam, S. (2024). Asset liability management model based on duration and convexity for commercial banks. In Advances on Mathematical Modeling and Optimization with Its Applications (pp. 187-204). CRC Press. https://doi.org/10.1201/9781003387459-13

Ju, C., & Zhu, Y. (2024). Reinforcement Learning-Based Model for Enterprise Financial Asset Risk Assessment and Intelligent Decision-Making. Applied and Computational Engineering, 97, 181-186. https://doi.org/10.54254/2755-2721/97/20241365

Kashyap, A. K., Tsomocos, D. P., & Vardoulakis, A. P. (2024). Optimal bank regulation in the presence of credit and run risk. Journal of Political Economy, 132(3), 772-823. https://doi.org/10.1086/726909

Kaviani, M., & Fakhrhosseini, S. F. (2023). An Analytical Approach to Asset and Liability Management Through Duration Metrics and Its Impact on Bank Performance. New Research in Performance Evaluation, 2(2), 91-101. https://www.journal-mrpe.ir/article_181690_en.html

Khosravianni, Z., Zomorodiyan, F., & Fallah Shams, M. F. (2023). Designing an Optimal Asset-Liability Model Using Multi-Objective Decision-Making Methods with a Focus on Liquidity, Credit, Balance Sheet, and Capital Adequacy Risks. Financial Engineering and Securities Management, 29(100), 65-103. https://journals.iau.ir/article_703288.html?lang=en

Lysiak, L., Masiuk, I., Chynchyk, A., Yudina, O., Olshanskiy, O., & Shevchenko, V. (2022). Banking risks in the asset and liability management system. Journal of Risk and Financial Management, 15(6), 265. https://doi.org/10.3390/jrfm15060265

Mahdavi Panah, H., Khalili Araqi, M., Montazer, M., & Vakili Fard, H. R. (2023). Analyzing the Impact of Central Bank Regulatory Laws on Financial Inclusion in Iran's Islamic Banking System. Islamic Financial Researches, 12(4), 839-874. https://ifr.isu.ac.ir/article_77067.html?lang=en

Mahdawi, T., Sinaga, S., Collyn, D., Zalukhu, R. S., Saputra, J., Ilham, R. N., & Harianto, S. (2021). Analyzing the banks' performance through financial statements: An application of the modified du pont method Proceedings of the International Conference on Industrial Engineering and Operations Management,

Malloy, M., Martinez, F., Styczynski, M. F., & Thorp, A. (2022). Retail CBDC and US monetary policy implementation: A stylized balance sheet analysis.

Mhejir, J. H., Hakmati Farid, S., Reza Zadeh, A., & Mohammad Zadeh, Y. (2024). Investigating the Impact of the Shadow Economy on Financial Market Performance and the Banking Sector of Member Countries in Asset Management and Financing. 13(2), 1-28. https://amf.ui.ac.ir/article_29048.html?lang=en

Peykani, P., Sargolzaei, M., Botshekan, M. H., Oprean-Stan, C., & Takaloo, A. (2023). Optimization of asset and liability management of banks with minimum possible changes. Mathematics, 11(12), 2761. https://doi.org/10.3390/math11122761

Reisi, M., Zare, H., Ebrahimi, M., & Aminifard, A. (2023). Money Creation in the Banking System Using Various Accounting Entries in Accrual and Cash Basis in Bank Balance Sheets. Journal of Islamic Economics and Banking, 12(45), 29-72. https://mieaoi.ir/article-1-1292-en.html

Samsami, H., Hassanpour, H., & Nojavani, M. A. (2023). The Impact of Removing Fictional Assets from the Bank Balance Sheet on Money Supply and Other Macroeconomic Variables. 12(1), 249-270. https://journals.shirazu.ac.ir/article_7690.html?lang=en

Shahniaei, Y., Nazemi, A., & Namazi, N. R. (2024). Designing a Model for Asset and Liability Management in Agricultural Bank of Iran. Monetary and Financial Economics, 14(54), 129-159. https://danesh24.um.ac.ir/article_45904.html?lang=en

Shahrabi Farahani, A., Qanbarian, R., & Daneshfar, S. (2023). Providing a Framework for Managing Debts in Tehran Municipality. Urban Economics and Planning, 4(2), 66-82. https://www.juep.net/article_174200.html?lang=en

Taheri, F., Setayesh, M., Janani, M. H., & Hematfar, M. (2025). Presenting an Asset and Liability Management Model for Banks Based on Risk Management Using a System Dynamics Approach. Investment Knowledge, 14(54), 129-159. http://www.jik-ifea.ir/article_23534.html?lang=en

Truong, V. T., Le, L., & Niyato, D. (2023). Blockchain meets metaverse and digital asset management: A comprehensive survey. IEEE Access, 11, 26258-26288. https://doi.org/10.1109/ACCESS.2023.3257029

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Ebrahim Azarkamand (Author); Seyed Rasoul Hosseini; Vahid Mahmoudi, Habib Amirbeiki Langroodi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.